ai1 Technologies Introductory Video

Why Choose the ai1 Lending Suite?

AI1 Lending Suite: Redefining Loan Processing

Realtime loan evaluation that adapts to market shifts for precise ratios and datadriven decisions—now expanding to a Marketplace/Bidding Lending Portal (coming soon) where qualified lenders algorithmically compete for qualified applicants in transparent, realtime exchanges.

Adaptive, Real-Time Decisions

Leveraging GDP, rates, inflation, unemployment, and sentiment, AI1 keeps affordability, pricing, and exposure limits aligned with both micro and macro dynamics.

Live Lending Neural Network

AI1 functions as a “Live Lending Neural Network” (ScoreAI), blending historical and streaming data to deliver updated underwriting signals, explainable risk views, and instant pricing.

Cutting-Edge Technology

Our stack combines KANs, deep learning, fuzzy metrics, and specialized stacked ensembles for accuracy and interpretability—plus pioneering ports to Physical Neural Networks (e.g., Microsoft’s AOC) for nextgen performance.

Advanced Capabilities: More Than just an AI Lending Solution

“Loan snapshotting” and whatif analysis let teams test scenarios and see impacts instantly. Intake is streamlined via the ai1 Secure Lending Agent (chat/voice) or web forms—integrating cleanly with your existing platforms. AI1 is open and ready for your stack via ScoreAI APIs and LOS integrations (LendingPad, ICE Encompass (coming soon)) with realtime sync, plus chat and voice AI assistants for borrowers and loan officers.

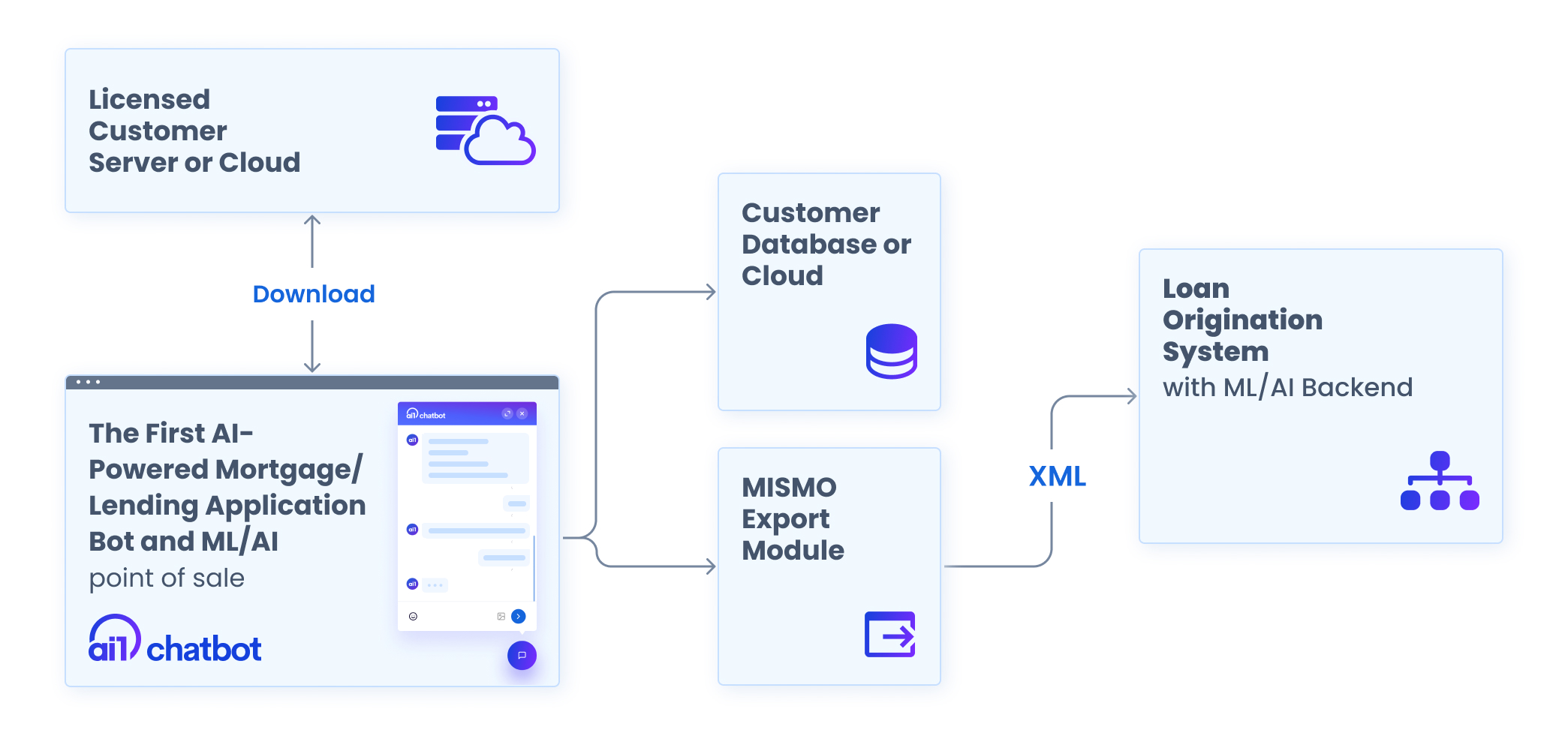

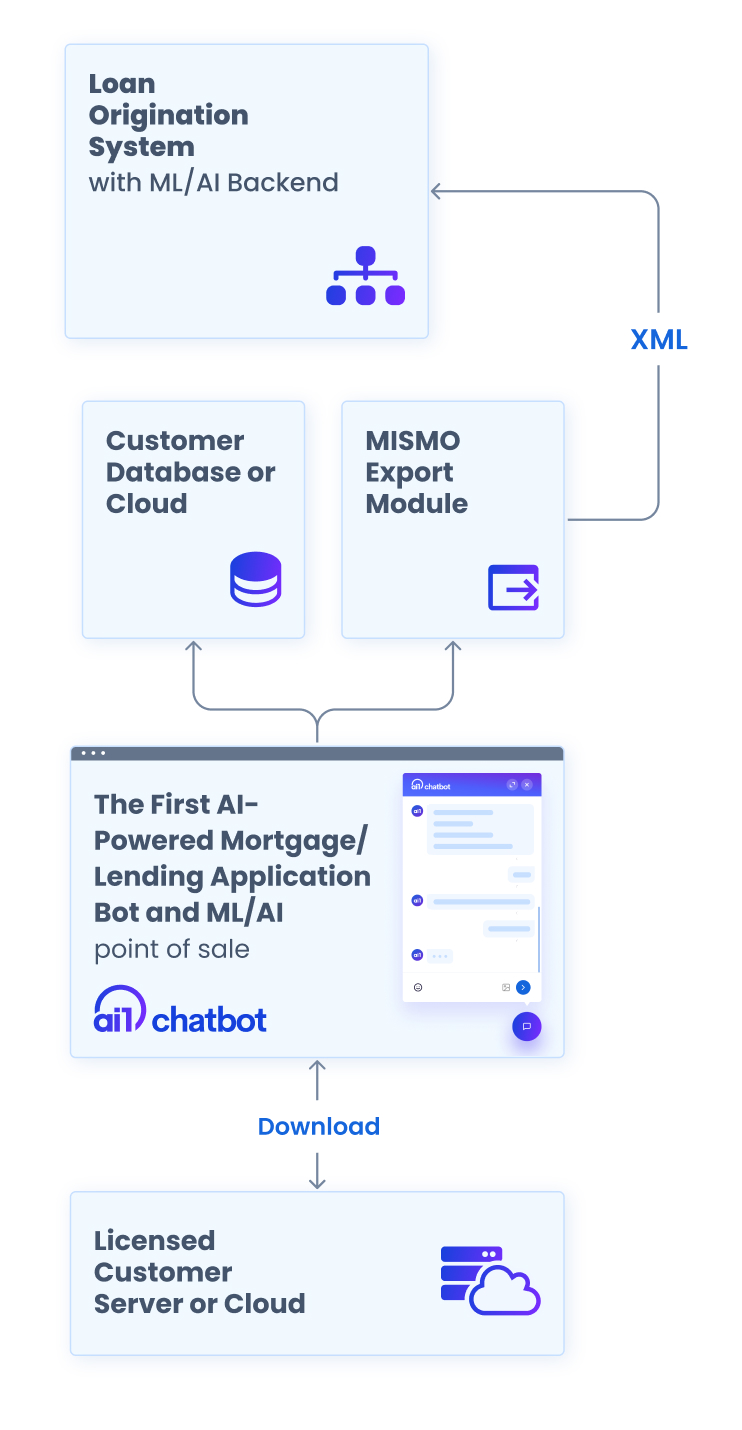

How It Works

The ai1 Lending Suite integrates seamlessly to power smarter, faster, more transparent lending. Request a Demo to see it in action.

Step by step overview:

1. Intake. Applicants use the ai1 Secure Lending Agent (chat/voice) or web forms; data is validated and normalized.

2. Scoring & Pricing. ScoreAI™ fuses borrower data with live macro factors to produce explainable risk, pricing, and limits in seconds.

3. Scenarizing. Run whatif and stress tests across policies, affordability, and expected loss curves.

4. (Coming soon) Marketplace. Qualified lenders algorithmically compete in real time—offers stream in like an auction with transparent rules and full auditability.

5. LOS Sync. Decisions, docs, and audit trails sync with LendingPad and ICE Encompass for smooth workflows.

6. Monitoring. Continuous learning keeps models current as the economy shifts.

7. Oversight. Detailed logs and controls support compliance, consistency, and fairness.

Marketplace/Bidding Lending Portal (coming soon)

A first of its kind real time lending exchange where qualified lenders algorithmically compete for qualified applications in transparent backend auctions — guided by a network that reasons over the evolving economy, not just credit scores. • ai1 AI Lending Portal is not just a marketplace — it is a real time exchange where lenders bid real-time, matching them with applications, guided by economics aware AI.” • Every bid is context aware — priced to the applicant’s risk and the current economy via KAN powered income/revenue/credit modeling. • Borrowers see auction style offers. Lenders win the right deals faster with clearer risk. Regulators get full transparency.

Register for an Early Previewai1 Technologies: Your Trusted Partner in AI Transformation

We don’t just ship tools — we guide your AI journey. With the ai1 Secure Lending Agent and ScoreAI back end, you get automation, insight, and responsible deployment with ongoing monitoring and human oversight.

Book a No-Obligation AI ConsultationSeamless AI Integration Tailored to Your Needs

From data connectors and decision APIs to LOS orchestration and reporting, we tailor a fullscale POS + ScoreAI solution to your policies, products, and risk appetite.

custom product

ai1 Technologies Can Work With Your Organization to Develop Cutting Edge AI and ML Projects

Learn more todayContact Us Today

Discover how ai1 can unlock the full potential of AI and ML in mortgage and banking. Reach out now to explore the limitless possibilities and transform your business for the future.

Thank you!

We have received your message and will respond within 24 hours

Having problems sending the message

We are already working on fixing this. Try to reload the page and send a message again or contact us via social networks.

Please do not send messages so often

To avoid spam emails in order not to miss really important messages, we set a limit on sending 1 message per minute. If you want to send another message, wait a minute and reload the page.